Rising College Tuition Threatens First-Generation College Student’s Education

SAN JUAN - A PSJA alumni said he has to get creative to find ways to pay for his college degree.

Robert Alviso said he’s still figuring out how he will pay off the spring semester at Baylor University. He’s three semesters away from graduation, but college costs keep going up.

Alviso is a first-generation college student. He wants to become a flight surgeon and a neurosurgeon for the U.S. Air Force.

The college student said he chose Baylor University for its prestige and its pre-med program. The university also offered him more scholarships than any other college he applied to.

About half of Alviso’s tuition was paid for in scholarships and financial aid his first two years. He works in the school cafeteria during the year and at a family business in the summer to cover the rest, although he said they are still not enough.

“I’d go to thrift stores or the flea market and find things that people wouldn’t consider valuable, make them valuable and try to sell them,” he said.

Alviso is currently asking for help on the internet with a GoFundMe account. He said the small amount he’s raised in nearly two weeks won’t help him go far.

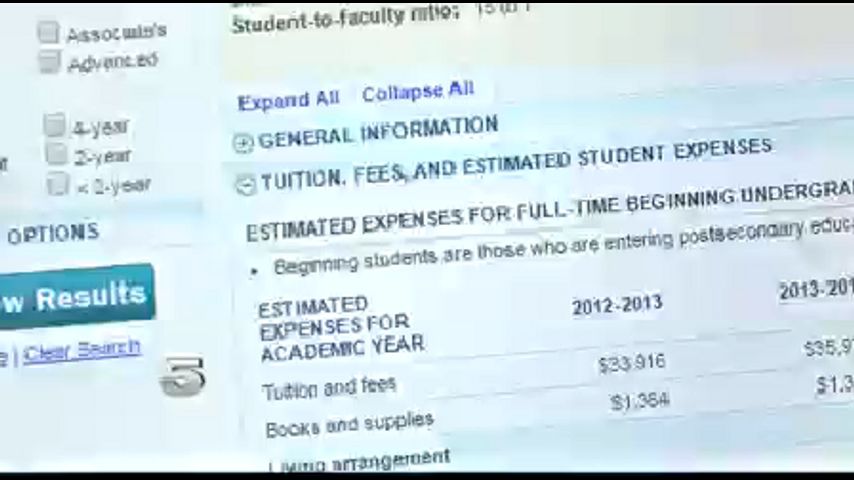

According to the National Center for Education Statistics, tuition at Baylor University last academic year was more than $40,000. There has been a steady increase in tuition within the past two years. The figure does not include books or rent.

CHANNEL 5 NEWS learned private and public universities’ tuition costs are increasing alike. The University of Texas Rio Grande Valley’s tuition costs went up 41 percent, according to the government website.

The website also showed the national average cost for one year of college was about $3,000 in 1983 compared to $15,000 in 2013. However, not all colleges have raised their tuition. The University of Texas at San Antonio and Texas A&M University-Kingsville’s tuition remained the same.

Despite taking out federal loans, Alviso said he still owes Baylor for the upcoming spring semester.

“Nothing I can find except private loans, but my family doesn’t have the credit for the private loans. So, I’m doing whatever I can just to continue my semester and my college experience,” he said.

Alviso said his last resort would be to transfer to a cheaper, public school.

The deadline to apply for financial aid for the 2017-2018 school year is March 15th for public colleges and universities in Texas. Students can fill out an application for federal student aid or FAFSA online.

Graduates who are still paying off federal loans can use a mobile application to make payments easier. They can download the My Fed Loan app to their smartphone and see all their account information.

Link: Universities’ Tuition Costs

Link: Trends in the Costs of College Education

Link: National Center for Education Statistics College Navigator